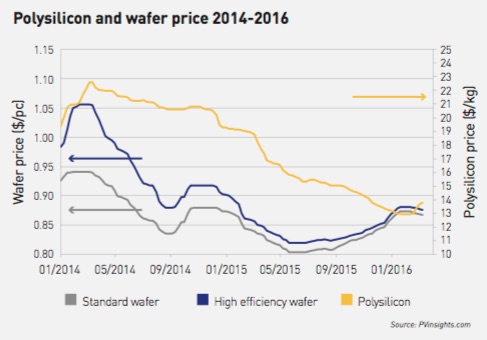

The volatility of the PV supply chain continues to give headaches to PV Crystalox, makers of the silicon wafers used in photovoltaic cells. In their half-yearly report, released on 25 August, they reported favourable market conditions up until May, after which wafer prices plunged to new historic lows.

At the same time the price of polysilicon, the key raw material used to make the wafers, surged after having decreased regularly since the start of 2015. As a result, the wafer sales price no longer covers the cash cost of production. The future is unclear, with the market still dominated by dumping and anti-dumping disputes. Only a new French scheme to support PV modules made with low carbon imprint offers some relief, since the company is well positioned to benefit.

Historical prices for polysilicon and wafers up to May 2016. The beginning of the dip in wafer prices and the rise in polysilicon can be seen on the right (from www.pvcrstalox.com)

In search of stability the company had entered into long-term contracts both for the supply of polysilicon and the sale of wafers. Whereas the supply contracts have been successfully terminated or renegotiated, the major sales contact has been a problem and is going to arbitration with the ICC. The date of the first hearing has now been postponed until November. If successful this claim could bring “..a multiple of the Groups’ market capitalisation” and affect future plans.

In the meantime results for H1 2016 are good, with revenues up at €34.7 million (H1 2015: €33.4) and a profit of €4.7 m (H1 2015: loss of €9.5 m). Net cash has also improved to €24.8 m from €12.7 m at end 2015. A major factor in all results was the sale from inventory of a large stock of polysilicon at a favourable price.

Unfortunately these results are not expected to continue. When the future looked brighter the Board planned to extend their strategic review to assess the implications, as we reported in March. Now they say, rather ominously, that if adverse conditions persist they will reconsider this extension “…in order to protect the interests of shareholders”. The rollercoaster ride continues.