By Barney Smith

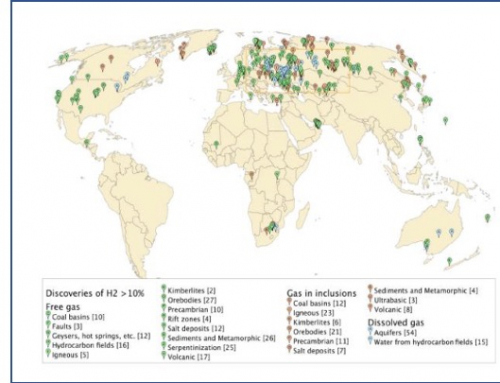

Hydrogen is increasing being talked about as a “Miracle Cure” for those industries which are highly resistant to decarbonisation, like cement and heavy transport . There is no doubt that interest in hydrogen is on the rise worldwide, for hydrogen and its derivatives, ammonia and methanol, have the enormous advantage that they can be consumed in full, leaving water as the only visible emission.

As of now, the IEA estimates that of the100 million tons of hydrogen currently used, virtually all is the so-called “gray“ hydrogen, created by electrolysis but ultimately derived from fossil fuel electricity, most of which is for use in the fertilizer, or the oil refinery, businesses. The type of hydrogen is important: the IEA estimates that by 2050 world need could be of the order of 500 million tons a year.

www.nationalgrid.com

Ideally what is needed for the future is “green” hydrogen, also from electrolysis, but ultimately derived from renewable electricity. But there is also” blue” hydrogen, the subject of much lobbying from the big oil and gas companies on the grounds that it could be produced from methane, with the carbon dioxide that is a bi-product of the process to be stored by Carbon Capture and Storage (CCS). There is a catch: blue hydrogen would depend on the Storage part of CCS, which has yet to entirely resolve its own problems.

In Asia the picture looks somewhat different. Japan is leading an import surge. That is understandable: Japan has over the last decade produced less than 14 % of its energy needs (the equivalent figure for the United States in 2020 was 106%). As a result the Japanese are quite accustomed to importing their way out of trouble, or as a road to start what they hope will become a trend. Hence the announcement in April 2023 of plans to quadruple their hydrogen target by investing US$ 107 billion in the hydrogen supply chain in the next 15 years. To show that this is no idle threat, Japan can point to two “first in the world” transactions: one is ammonia from Saudi Arabia; the other is liquefied hydrogen from Australian coal. Leaving aside the emission credentials of the exporters, Japan’s pioneering efforts to establish a new global supply chain are clear.

They will want other countries to jump on the bandwagon as importers of hydrogen or exporters of renewable electricity. Elsewhere in Asia, the Japanese have something to build on: South Korea is home to the world’s largest fleet of hydrogen-powered cars and China has a long-term ambition to dominate this emerging sector of the world-wide automobile industry.

The big obstacle is currently price: hydrogen is expensive. A key objective is to get the price of “Green” hydrogen below that of “Blue” hydrogen. But, at best, that will take time. Given the likely permanent competition risks with “Green” hydrogen, the big danger is that sustained pressure from lobbyists results in a confusion between those sectors where hydrogen is credible because there are few other possible alternative net-zero possibilities and those sectors which areessentially only buying time: there will be cheaper options for them.

I am indebted to Putra Adhiguna (IEEFA in Australia) for much of the above, especially the detailed figuring on Asia.