By Stewart Dalby

We last wrote about Ilika plc on 18 June 2020 when we commented on the AIM-listed company’s final-results for the financial year (FY) 2019/2020 which ended on 30 April 2020. At that point the company was loss-making and had a share price of 51 pence. Last week on 14 January the interim results for the six months of 2020 which ended on 31 October. They showed that the company was still a loss-maker but its share price had reached a 52-week high of 250p before falling back to 190p on 14 June 2020. So, what had been going on during the six months?

One development in the period was that certain sectors within the renewable energy category such as, waste management companies, fuel cell related hydrogen developers and groups involved in battery technology, had by June 2020 shot to the forefront of the renewable energy conversation. Stakeholders, it seemed, were making major investments for growth tomorrow and ignoring the loss making of yesterday.

Ilika plans to scaleup its stereax mini-batteries for use in the ‘Internet of Things’

Tfhe appeal of these companies stems from their excellent capabilities as energy carriers and storage mediums. Thus the £2,479.27million market cap Ceres Power, which through its fuel cells is involved in fueling and storing hydrogen for vehicles and other activities, saw its 52- week share price range go from a low of 256p to a high of £14.36p. Last evening it was £14.28. ITM Power, which is also involved in hydrogen fuel, storage and refueling has a similar tale to tell. Its 52-week range was a low of 96.95p to a high of 666.00p.

Ilika Plc has been a little behind the curve in terms of product development and financing–it has been heavily dependent on government grants—compared to Ceres and ITM. There are in theory, however, reasons other than general market sentiment to attract investors to Ilika and keep the share price flying high.

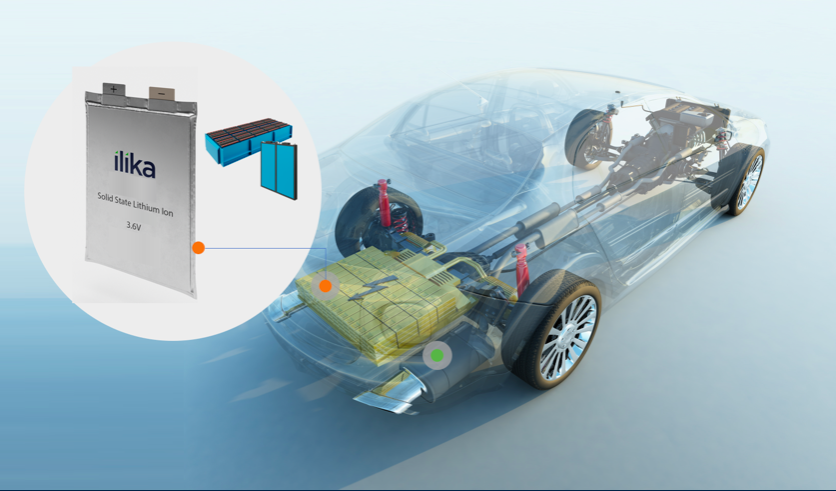

It has a ground-breaking product in development in its Stereax mini-battery, for a start. There is also another product in prospect in the form of a large lithium ion battery for electric lorries known as Goliaths.

There has been a lot of praise for and endorsement of Stereax. Unlike some other lithium-ion batteries they have no liquid components and there are advantages with solid state batteries in many areas. They have greater energy density, are faster charging and last longer. They are safer and less flammable.

These micro batteries are really suitable for industrial and medical use (such as implants) and suit the ‘internet of things‘ market. You would think with all these advantages Stereaxs’ would be able to advance IIika’s progress towards commercialism. In fact, progress has been made but only at a snail’s pace.

Last June, at the time the 2019-20 results were released, I had the opportunity to talk to Ilika’s CEO Graeme Purdy about Stereax, revenue and what were the developments in train. Mr Purdey began by saying: “We started making batteries years ago at the Department of Chemistry of the University of Southampton. Since 2015 we have focused on developing miniature solid-state batteries such as Stereax M250 and P180 IP and are still producing them as a pilot project” The development of these batteries did not come cheap and finances were a worry, Mr Purdy said: “If you look at the results for the financial year just finished on April 30, revenue was £2.8 m. Only £600,000 was from the mini-batteries. The rest, £2.2m, was from UK grants and this was used to develop lithium-ion batteries for Goliath lorries. Briefly explained, all of the above means the company’s products were in development, and the non-grant revenue stream was poor.

What a difference the second six months has made. There was still grant income coming into Ilika’s coffers in the months to October 2020. The real game-changer, however, was that on 6 March 2020 the company announced that its over-subscribed Placing and Open Offer had raised in aggregate £14.2m after expenses. These monies are being used to scale up production and move closer to commercialization– and the plan seems to be working.

Broker Baden Hill commented on the plan saying: “Ilika is closing in on commercialising its’ state-of-the-art Stereax solid state battery platform. It plans to increase capacity by 70 times at its custom plant by the end of 2021. As for Ilika’s large format ‘Goliath’ electric vehicle (EV) programme, under a framework agreement with the UK Battery Industrialisation Centre (UKBIC) Ilika is targeting a weekly output of 5MWh by 2024. This is considered to be ’significant’.

Liberium,Ilika’s house broker commented on the interims saying that losses at the second six-month stage ended 31 October 2020 were £1m, the same level as the previous year. It added, however, with all the scaling up going on its own revenue forecasts are £5m for 2022 and £13m for 2023.The share price of market cap Ilika was 242.50p last evening.

- Stewart Dalby is a shareholder in Ilika.

By Stewart Dalby| June 18th, 2020|Ilika