We wrote about AIM-listed Altona Energy on 15 August 2016. The first paragraph of our report said that “Altona last appeared in Greenbarrel in February 2014. Since then there have been a lot of changes but little progress.” What was meant by this was that the company, despite on-and-off offers of huge financing from Chinese interests, seemed to be getting nowhere in using a massive coal resource that the group had acquired, to advance an exciting-sounding Coal-to-Liquids (CTL) project.

Now, more than four years further on there have a lot more changes, but they are perhaps not the kind of changes that investors were lead to expect.

Altona holds licenses to explore the large Arckaringa coal deposits which could have been converted into the equivalent of 7.8 billion barrels of fuel. These deposits lie below an uninhabited area of South Australia, covering about 2,500 sq kms, around 600 miles NW of Adelaide. At the time the licences were acquired in 2005 it was felt that coal could be extracted from a conventional open cut coal mine, then processed in a Coal to Liquid (CTL) plant. Subsequent studies showed that a better economic solution was to build two plants, one for CTL and one for Coal to Methanol (CTM).

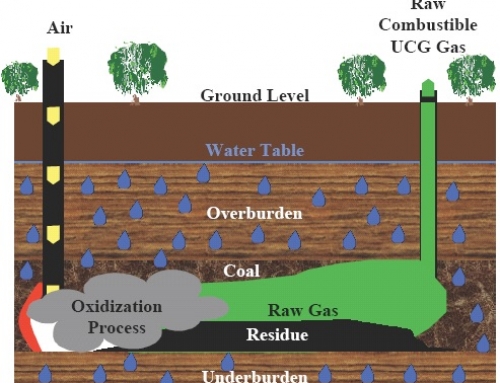

However, in 2014/15 the drop in the oil price and, possibly, the change in Australian government disrupted these plans. Costs were reduced by closing offices in Beijing and London. Above all, the objective was changed from CTL/CTM to underground coal gasification (UCG). The attraction of UCG is that most of the dirty work is done underground and the operation can be classified as clean-tech.

Altona’s Arckaringa coal deposits are 600 miles NW of Adelaide

UCG has been tried several times in different parts of the world, but has never been commercial. Altona started work on a three-year Bankable Feasibility Study for UCG. The next step was to have been to drill some exploration wells. At this point (28 July 2016) the group had been told by the South Australian government that in order to start this test drilling it needed to have a petroleum exploration licence (PEL).

As it happened there was a PEL on the relevant area that overlapped the group’s Arckaringa acreage, but it was owned by someone else. After much coming and going and various fruitless negotiations, Altona found that early in July 2017 it was unable to acquire the PEL 604 application. So no PEL, no UCG project.

By this stage (July 2017) the company’s financials were not in great shape. The loss before taxation for financial year ended 30 June 2017 was £341,000 against a profit in 2016. As at 30 June 2017 cash at the bank was £15,000 (30 June 2016: £362,000.) The share price in late July 2017 was 0.38pence up from a year’s low of 0.28p but well below the high of 1.3p.

Then on 19 August 2017 the company announced that it had been cogitating for some time on a change of direction and had settled on a new strategy of abandoning clean- tech activities and instead focusing entirely on conventional coal extraction from Arckaringa.

This plan was informed by the knowledge that the price for coal had more than doubled to US$100 a tonne since 2015 and this could transform the economics of extraction.

The Interim Results for the period ended 31 December 2017 were published on 29 March 2017 and seemed, to me, at least, the briefest of interims reports I have ever read.

During the period under review the report stated:-

A) The company changed its focus to a conventional coal mining project (something shareholders already knew).

B) Altona commissioned a number of new reports focused on identifying coal seams in less-wet areas

C) Stock market placings raised funds of £1.1m before expenses.

D) Nick Lyth was appointed Chief Executive Officer (CEO) and Philip Sutherland was appointed Director of Operations (Australia).

E) Administrative overheads were tightly controlled.

F) Cash at the bank as at 31 December 2017 was £756,000.

G) The financial loss for the six months was £258,000 against £241,000 for the comparable period in 2016.

Probably the most interesting facet of the Interims Results were the new reports looking at coal seams. In short, the various reports looked at three tenements (tenements in Australia are usually called concessions or licences elsewhere). The most propitious was the Westfield (EL 5676), which is estimated to contain 800 tonnes of coal. The investigations into this concession identified the Willougby seam as a strong possibility for exploitation being that it is 3-6 metres in thickness and runs at a depth of 80m or less in some areas.

What this means in layman’s terms is that the Willoughby seam is a substantial “less wet” resource ideal for open cut mining which is less costly than other methods. Nick Lyth said: “The group hopes to take advantage of high coal prices, by proving up its plan in order to provide a possible exit within a reasonable time frame”. This in turn means a sale, possibly to a Chinese concern.

Shares in the £5.18m market cap company were 0.33 pence last evening with a 52-week low of 0.15p and a high of 0.70p.