Torotrak is all about reducing fuel consumption and emissions from vehicles. With the continual pressure on manufacturers to improve in these areas, you might think that Torotrak was a safe bet. Why then has the share price fallen steadily from above 50p in 2011 to 2.0p today, with a particularly sharp drop in December?

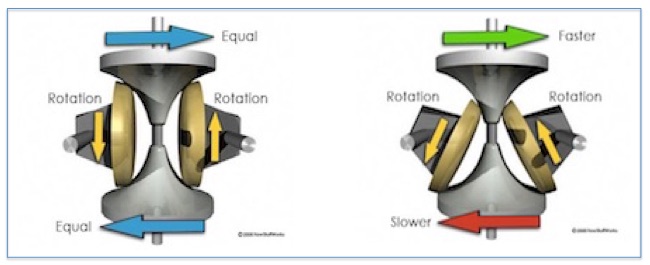

The heart of Torotrak’s technology is a continuously variable transmission (CVT) which provides a fast and completely smooth transition from low gearing to high gearing, unlike a traditional gearbox which changes in steps and loses efficiency in the process.

A toroidal CVT such as Torotrak’s. On the left the inner rollers are perpendicular to the outer disks, so both disks turn at the same speed. On the right, the top disk is obliged to turn much faster than the bottom one. With suitable additions a seamless transition from forward to reverse motion can be made, a so-called infinitely variable transmission or IVT. (from www.howstuffworks.com)

This technology is used to replace a vehicle’s gearbox, or as a component of two other systems: one that recovers energy normally lost while braking, known as a kinetic energy reduction system or KERS; and another that can supercharge internal combustion engines more efficiently (V-Charge).

The KERS has a flywheel that is set spinning when a vehicle slows down, capturing energy that would normally be lost. This energy is then recovered when needed. The variable transmission improves the interface between the fly-wheel and the driveshaft. This system was developed for Formula 1 cars by a company called Flybrid Automotive which was bought by Torotrak in 2014.

Torotrak’s business model is based on licensing the technology to vehicle manufacturers and their suppliers. They also do low volume manufacturing and provide engineering services related to their technology.

The problem is that license revenue has almost dried up. The drop in share price in December was caused by the postponement of a KERS licence agreement for off-highway vehicles until the 2017/18 financial year. Apparently the prospective licensee felt the global market for such vehicles (diggers, mining trucks) was deteriorating.

Between 2008 and 2015 Allison, an American manufacturer of transmission systems, paid £26 million for an exclusive licence of the IVT system for medium and heavy duty vehicles. However this has stopped pending the development of a smaller, lighter and lower cost version.

Other licences seem to have followed the same path. In 2015 the primary focus was on installing KERS in buses. Testing was successful, with fuel savings of 11 per cent and potential for more. However in 2016 the technology failed to qualify for a grant from the UK Government Ultra Low Emission Bus initiative. Bus operators also indicated that the minimum required payback time for new emission technology had fallen from 5 years to between 2 and 3 years. KERS thus became less viable for buses.

With the postponement of the KERS licence the most immediate hope is for V-Charge, which when added to a 1 litre 3-cylinder engine on a Ford Focus gave the same power as a standard 1.5 litre 4-cylinder engine. V-Charge adds some weight but the overall fuel saving is expected to be above 20 per cent.

Although there are several long-range prospects and on-going collaborations for all three products, Torotrak needs to find some licence revenue soon. Revenue for the six months to 30 September 2016 was £0.9 m, all from engineering services, while operating loss was £3.4 m. (£1.2 m and £7.4 m without exceptional items for the full year 2015/16.)

Cash and cash equivalents were £7.9m down from £11.3 in March 2016 while market capitalisation is now £11m. Capital may need to be raised. The last share offer was in July 2015 but a new one may be needed.