Ilika Plc’s share price has been climbing steadily since the end of November, reaching a three-year high in January after having declined steadily throughout most of 2019. No single event seems to have triggered this rise but it is likely that the world’s increasing interest in electric vehicles and the internet of things has finally caused the market to look at what Ilika has to offer.

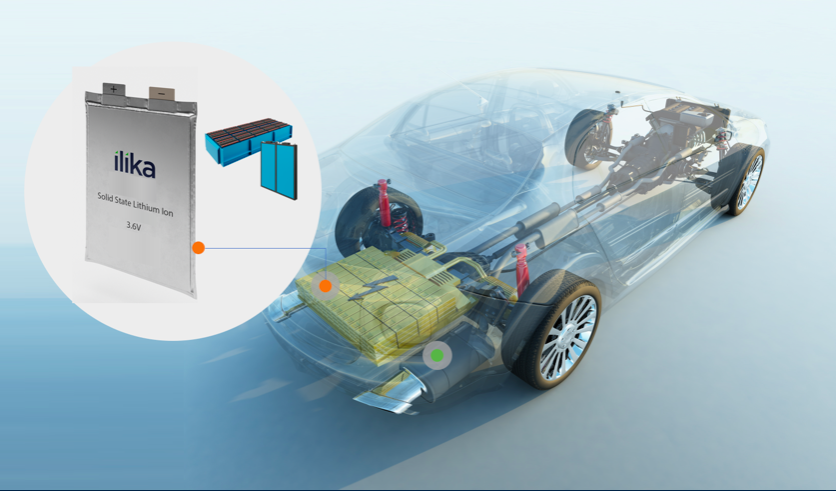

For the last four years Ilika has specialised in developing solid state batteries which, unlike lithium-ion batteries, have no liquid components. The company claims advantages for solid state batteries in almost all areas: safer and less flammable, greater energy density (hence smaller and lighter for the same output), faster to charge, longer lasting and with less internal current leakage.

For several years Ilika focussed mainly on miniature batteries for industrial and medical use. In some applications the battery was combined with an energy source, such as a small solar panel or vibration harvester, to power a wireless sensor. A typical example was the partnership with Titan Wind to develop a sensor to be mounted on wind turbine blades in order to to monitor their condition.

www.ilika.com

These applications have been highly specialised with the result that the company still resembles an industrial research and development centre more than a commercial enterprise. This is reflected in its financial results. For the half- year to 31 October 2019 Ilika reported a total turnover of £1.4m (H1 2018: £1.0m), but £1.2m of this was from UK grants. Revenue from sales was down from £0.3m in 2018 to £0.2m.

Graeme Purdy, CEO of Ilika, explains that the company cannot compete on price with the manufacturers of standard lithium-ion batteries because the latter have the advantage of very large production volumes and well-established procedures. Hence Ilika’s focus on specialised niches in which its solid batteries provide critical advantages.

Could this be about to change? Since 2018 Ilika has worked on developing large batteries suitable for electric vehicles. These so-called Goliath batteries are indeed huge compared with the previous products. The battery in a Tessla model 3 stores more than 50 million times as much energy as the products so far produced by Ilika. However the potential advantages for electric vehicles are also large.

According to Mr Purdy his batteries can provide twice the energy for the same volume and weight as lithium-ion. This means twice the range for the electric vehicle. This is a big advantage but needs to be placed in context. It may be true for batteries in a laboratory, but once these have been ruggedized and packaged to handle the rough conditions of road travel the overall weight may not be so different.

The other major claim is that the solid state battery can be charged six times more rapidly. This is indeed impressive and would not only reduce stress on impatient drivers but would could save millions in recharge stations.

These developments have been strongly supported by the UK Faraday Battery Challenge who first awarded £2.3m to Ilika in 2018 to develop a pre-pilot manufacturing line for Goliath batteries in a 30 month project with Honda, Ricardo, an engineering firm, and others (the PowerDrive Line project). At the same time Ilika was awarded £1.8m in a 2 year project headed by McClaren to develop new battery materials.

As a result Ilika opened a large format battery facility in Hampshire in September 2019 (the Goliath Pre-Pilot Line), with over 600 square metres of laboratories and production equipment. A new 18 month Faraday-funded project was also announced (the Granite project). This is headed by Jaguar Land Rover and includes the manufacturer AGM Batteries and Warwick Manufacturing Group. It is worth £0.9m to Ilika and is aimed at exploring cost-effective routes for scaling up solid state technologies.

All this is good news for the company, although the fact that it is still talking about the pre-pilot stage indicates that there is a long way to go.

In the meantime the losses continue. In the half year to 31 October the pre-tax loss was £1.6m (H1 2018: £1.5m), in line with previous losses which have never been less than £2.7m in a year. However with such strong pressure to convert to electric vehicles it is likely that Ilika will continue to receive substantial funding and may eventually be highly profitable.