The share price of Ceres Power Holdings has been increasing steadily from 213 pence at the end of November to an all-time high of 352p today. This may well have been caused by Ceres’s announcement at the beginning of November that it was producing a new range of its SteelCellTM products that ran solely on hydrogen as input.

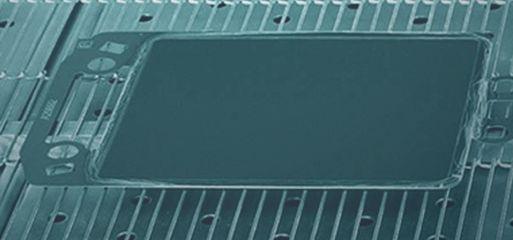

The steel cell is a solid oxide fuel cell that has some advantages over the more commonly used alkaline or proton exchange membrane cells. One is that it can produce electricity from impure hydrogen, in fact everything from hydrocarbons to pure hydrogen. The hydrocarbons are reformed, i.e. converted, into hydrogen and carbon gases before being fed to the cell. Since the hydrocarbons are not being burnt the cell is a more efficient use of energy and no particulate matter is emitted. The amount of carbon emitted for a given power output is also less.

In the last few years Ceres has successfully sold its systems for a variety of applications from stand-alone generation for data centres to electric vehicles. The input fuel has usually been natural gas, although Nissan uses the steel cell in its e-Bio Fuel Cell car. This was designed to run on ethanol in Brazil where the latter is made from sugar-cane and is available in filling stations.

www.cerespower.com

In offering a hydrogen-only product Ceres would seem to be giving away its advantage in fuel flexibility and putting itself in direct competition with other fuel cell types. (There is still some benefit in that it can use impure hydrogen.) However Ceres is clearly keen to show that it can produce a system with zero emissions, and is distinguishing its product by offering a Combined Heat and Power (CHP) system.

Ceres claims that the electrical efficiency of this device is 50 per cent with an overall efficiency in heat and electricity of 90 per cent. The definition of efficiency is a slippery subject, but this is comparable to that of a CHP system powered by natural gas. Unfortunately natural gas is natural whereas hydrogen is not – it must be produced by reforming natural gas or by electrolysis. Both of these take energy that is not included in Ceres’s claim. The total efficiency is therefore considerably less.

Interestingly, for many years the main hope for the steel cell was in residential and business CHP systems using natural gas as the fuel, but this was only moderately successful so the focus changed to joint development agreements with manufacturers such as Bosch and Weichai. CHP did not go away entirely: in June 2019 Miura Co of Japan announced a new 4.2kW CHP system for commercial properties developed in partnership with Ceres.

Compared with previous fuel flexible systems the new hydrogen CHP system will be smaller, simpler and cost 40 per cent less because the input gas no longer needs to be reformed. But for the same energy content hydrogen currently costs two to three times more than natural gas, and since most hydrogen is produced from the latter without capturing the emitted CO2 it is not carbon free. Until these problems are resolved hydrogen systems are unlikely to take off.

The role of hydrogen in future energy systems still has to be determined. Every so often the difficulties that arise with electric cars and heat pumps cause people to look for other solutions. For example Capital Economics, a consultancy, estimates that the number of chargers needed in the UK for battery-driven electric cars by 2050 is a huge 25 million, a rate of installation of 2300 per day from today. Hydrogen is a possible alternative not only for transport but also for heating and storage.

Whether Ceres’s recent share price increase is cause by a renewed interest in hydrogen or not it is certainly welcome news for Ceres shareholders. Although revenue has increased solidly over the years to reach £16.4 million for the year to June 2019, there was still an operating loss of £7.9m. Interim results to December 2019 are expected at the end of March.