The Renewables Infrastructure Group, TRIG, is an asset manager whose portfolio includes both wind and solar farms in the UK, Ireland, Corsica and the south of France. The wind farms were all onshore until 2017 when the company bought an interest in its first offshore wind farm, Sheringham Shoal off Norfolk. Electricity production in 2017 was 1766 GWh (4.4 per cent of the total UK onshore wind and solar).

TRIG has no employees and is run by 4 non-executive directors who monitor and control an Investment Manager and an Operations Manager. The former is InfraRed Capital Partners, a leading global manager focused on infrastructure and real estate, while the latter is Renewable Energy Systems Ltd (RES), who claim to be the world’s largest independent renewable company and are a division of Sir Robert McAlpine. Thus there is no shortage of horsepower.

In the annual report for 2017 released on 19 February 2018 the company reported a profit before tax of £90.2m (2016: £67.9m) for a year-end net asset value per share of 103.6p (2016: 100.1p), giving a total investment return of 10.1 per cent, of which 6.4 per cent was paid out in dividends. The annualised return is7.1 per cent since the initial listing in 2013. Like a utility TRIG offers high dividends and a relatively safe investment. Much depends on a correct estimate of Net Present Value, which in turn depends on properly estimating wholesale electricity prices, government regulations, interest rates and future production.

Future production may vary from year to year but the long-term average is predictable assuming properly maintained equipment. Government regulations concerning renewables are assumed not to change significantly in the UK or Europe, although the general business environment (corporation tax, growth etc) presents more risk. TRIG says that it might invest outside Europe to spread the risk, but guarantees to have no more than 50 per cent invested outside the UK.

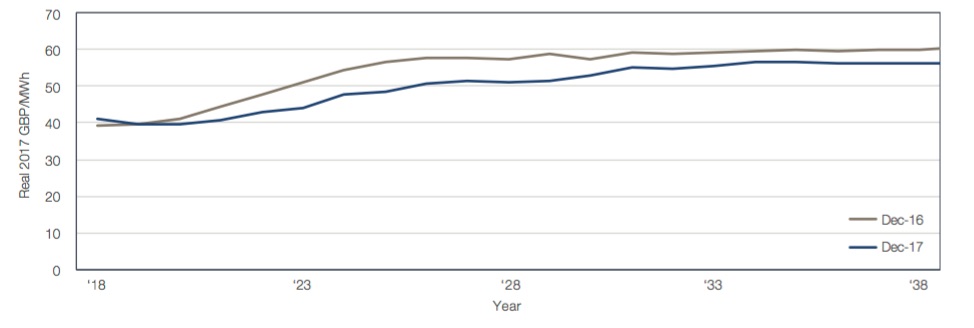

More interesting is the effect of future electricity prices, as shown below. Previously the company had assumed a gradual rise from inflation, but now it expects a drop in the short term on the basis of excess gas supplies in Europe and weak demand, followed by a gradual increase above inflation of about 2 per cent. Note that the prices are in 2017 pounds.

Illustrative blended power price curve (real prices) for TRIG’s portfolio for the markets it is involved in and net of discounts (from Annual Report 2017)

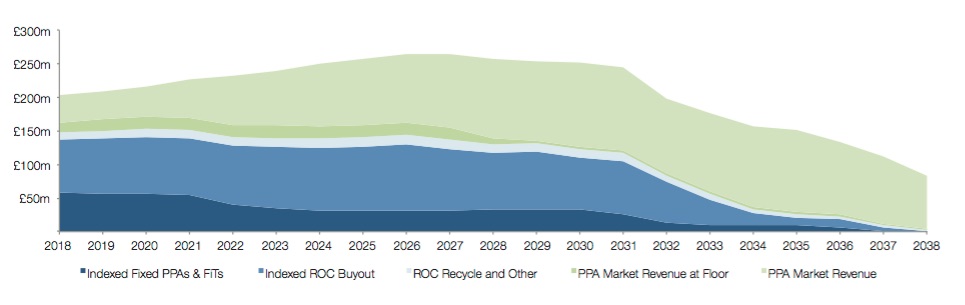

In practice TRIG is not much affected by prices in the short term because two-thirds of its revenue comes from fixed power purchase agreements, renewable obligation certificates and other supported prices (see chart below). Even in the medium term many are indexed to inflation so it is only in the 2030’s that these subsidies are disappear.

Illustration of the split of project revenues by contract type for the portfolio

(from Annual Report 2017)

Asset managers tend to focus on the purely financial aspects of their assets and ignore the wider industry trends (see our previous article on Greencoat UK Wind). One major question is who will provide the storage to even out the variability of wind and solar power, and even more who will pay for it. TRIG does at least discuss the issue of storage, although it seems to think that storage will allow it to “….. capture higher prices…..” for its power. This is unlikely.

No doubt the consumer will bear the brunt, but there is a large risk (from the point of view of the asset manager) that the wind and solar provider will either have to provide the storage or receive a reduced price for a product that is intermittent and therefore less valuable than a constant nuclear or gas turbine source.

TRIG has, however, taken some action. In 2017 it purchased for £20.4m a 20MW battery developed by RES and won a contract with National Grid to provide a two-way grid balancing service. TRIG says that it will “…supply the grid with capacity to handle very short-term imbalances in the frequency”. This is useful first step, but many more are needed.

The share price of this £1billion market cap company was at 106.4p yesterday, close to its average since listing.