Nature Group PLC is incorporated in Jersey. It specialises in providing port reception facilities and waste treatment services to the oil, marine and process industries, and claims more than 25 years’ experience. But the consequences of the oil price collapse for the dedicated petroleum division have been severe, so the recent history of the company’s share price has been mixed, to say the least.

In the last year the share price has gone from 5p up to nearly 15p, down again to 7.13 p, followed by a slow fall to bottom at 2.63p before a brief spurt to 4.88 and then a further decline to today’s 3.25p. How much does this matter by comparison with the figures for revenue, profit/loss before tax, etc. Put it another way, does the movement in the share price reflect changes in these figures? (Obviously it changes the market cap. of the company immediately.)

To start with, it is perhaps worth trying to match the movement in the share price against the company’s announcements over the last fourteen months. On 19 September 2016 the company announced that it had purchased for US$675,000 the 25 per cent of Nature Environmental & Marine Services Ltd (NEMS) which it did not already own following the purchase of 75 per cent of NEMS in 2014 (thus incidentally putting an overall value of US$2.7 million on NEMS, which is based in Corpus Christi, Texas).

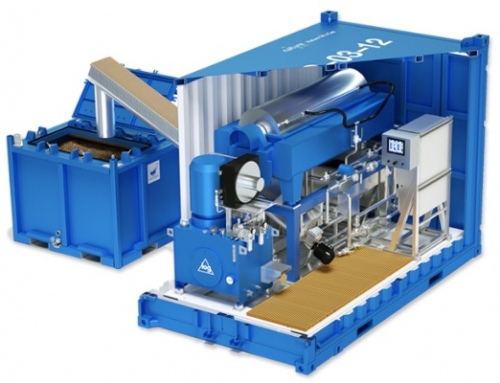

The transaction does not seem to have had much impact on the share price which remained just under 5p. By contrast, the share price jumped after the announcement on 22 December 2016 of a major five year contract with an international oil company worth “at least £5 million” for the provision of containerised slop-treatment units in the Central North Sea. Even more excitement was caused by the 17 January 2017 announcement that the Nature Group had successfully sold its (loss-making) Gibraltar facility for £4 million (£3million now and a further £1m which will linger in escrow for up to 2 years). The share price rose to 14.88 p yet it then declined to about 7p on 25 June 2017, before dropping precipitately to 2.63 by 29 June.

There was little change in the share price until 18 November 2017 when Nature Group announced that it had sold 50 per cent of NEMS to a member of a much larger Indian waste treatment group, the Ramsky group, which is the Nature Group’s 50/50 JV partner in a waste facility in the port of Sohar, Oman. 50 per cent of NEMS was apparently worth US$ 1.6m (of which US$ 0.45m is conditional on the firm meeting its targets in the next two years). There was also a loan of US$1m to NEMS to strengthen its balance sheet and a further loan of US$200,000 to the Nature Group itself from Ramsky, Singapore (the loan is guaranteed against Nature’s share of the Oman JV). The market’s response was positive: the share price went up immediately to 4.88p before quickly losing over 20 per cent in a single day to finish at 3.25p on Friday 24 November.

But it is not easy to see how this share price volatility reflects the picture derived from the Group’s recent reports. For the last interim which covered the period from 1 January 2017 to 30 June 2017, the period of some of these price movements, spoke rather of challenging market conditions, measures to reduce overheads, a strategic review and increased losses of £1.5m.

We have to hope that benefits will flow from greater cooperation with Ramsky, said to be the market leader in India, and perhaps from the recent increase in the oil price. But the AIM market seems to have its own logic.