By Julian Singer

Greenbarrel last examined the performance of AIM-listed renewable energy stocks in April 2022. Since then, we have had the continuing disruption of the war in Ukraine with its effect on energy prices, at the same time as much of the world is facing high inflation and higher interest rates. Closer to home there have been the upheavals caused by two changes of prime minister. In spite of all this, optimists might have hoped that the desire for more local sources of energy would spur investment in new renewable technology.

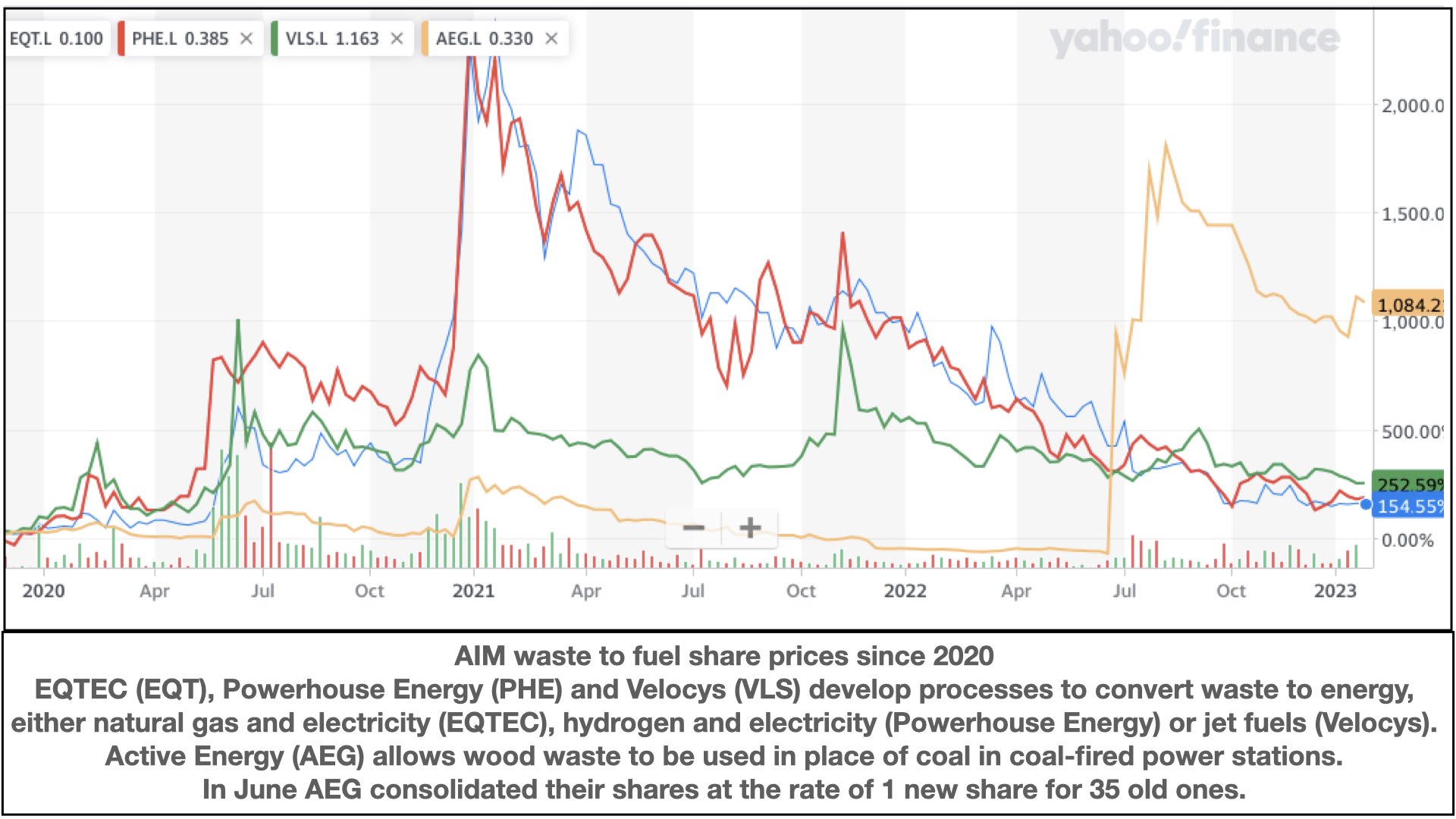

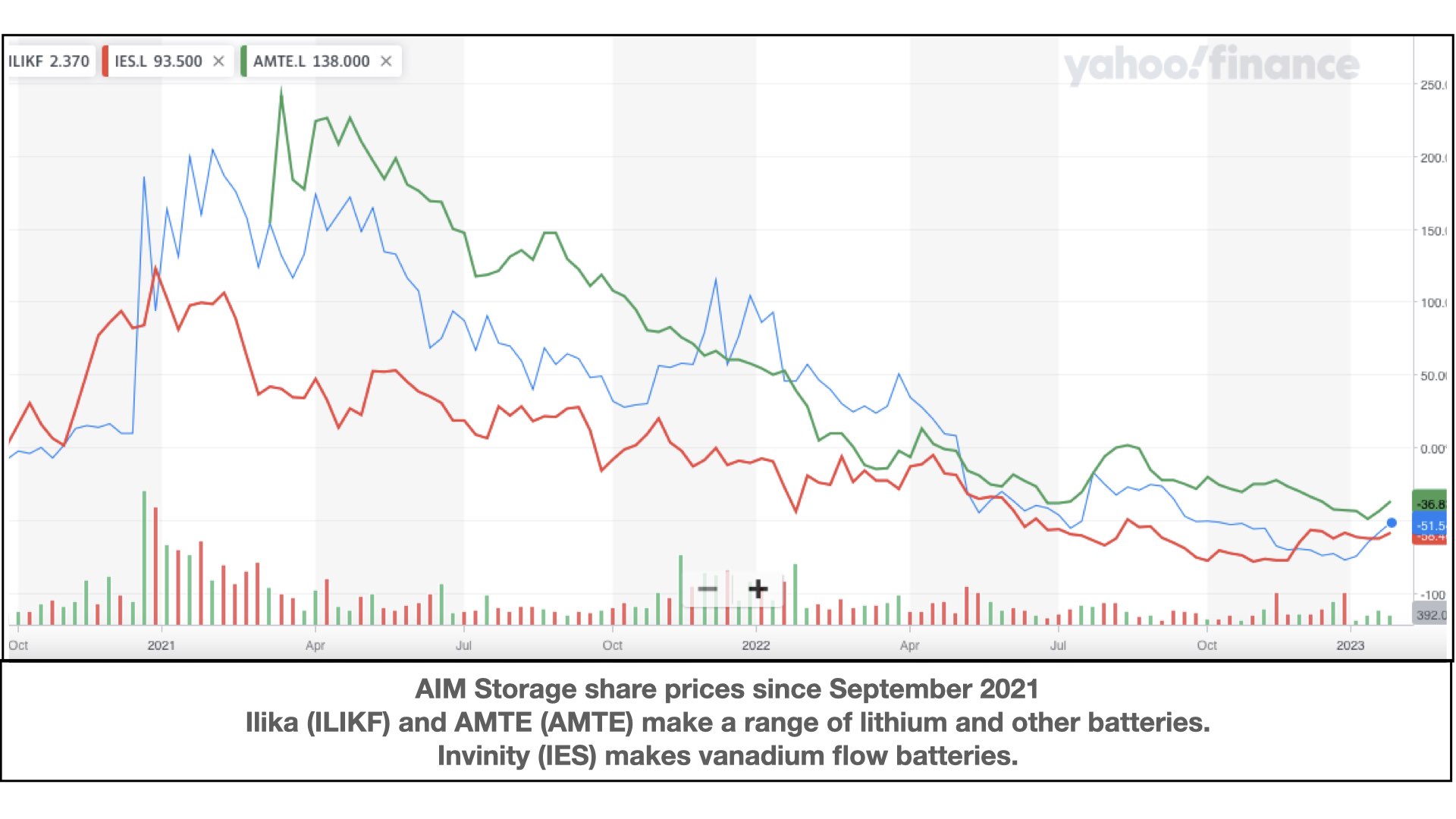

The stock market response has been mixed. In three areas in which new technology is being developed – hydrogen, waste and storage – share prices have drifted steadily downwards from their peaks in early 2021, as can be seen in the plots below. The hydrogen group is typical. It consists of companies developing hydrogen-driven fuel cells or electrolysers that produce hydrogen. Two of them, ITM Power and Ceres Power, account for approximately half the market capitalisation of AIM-listed renewable energy stocks, but neither have made a profit or yet shown a positive ebitda.

The consistent drop may indicate a lack of faith in hydrogen as the fuel of the future. However, the group of companies processing waste to produce energy and the group of storage, or battery, companies show the same trends. The common feature is that all are trying to commercialise a technology that is reasonably mature but has not yet been manufactured in volume. As Dennis Schulz, the recently appointed CEO of ITM Power, puts it “For the company to develop from an R&D and prototyping entity to a mature delivery organisation, we require firmer foundations”. Do all these companies lack the firm foundation, or is it simply that the demand is not yet there? For example, much is written about hydrogen but where are the projects that will use hydrogen at scale for storage, heating or transport? Or were the dramatic increases seen in late 2020 and early 2021 only a sudden enthusiasm that has since evaporated?

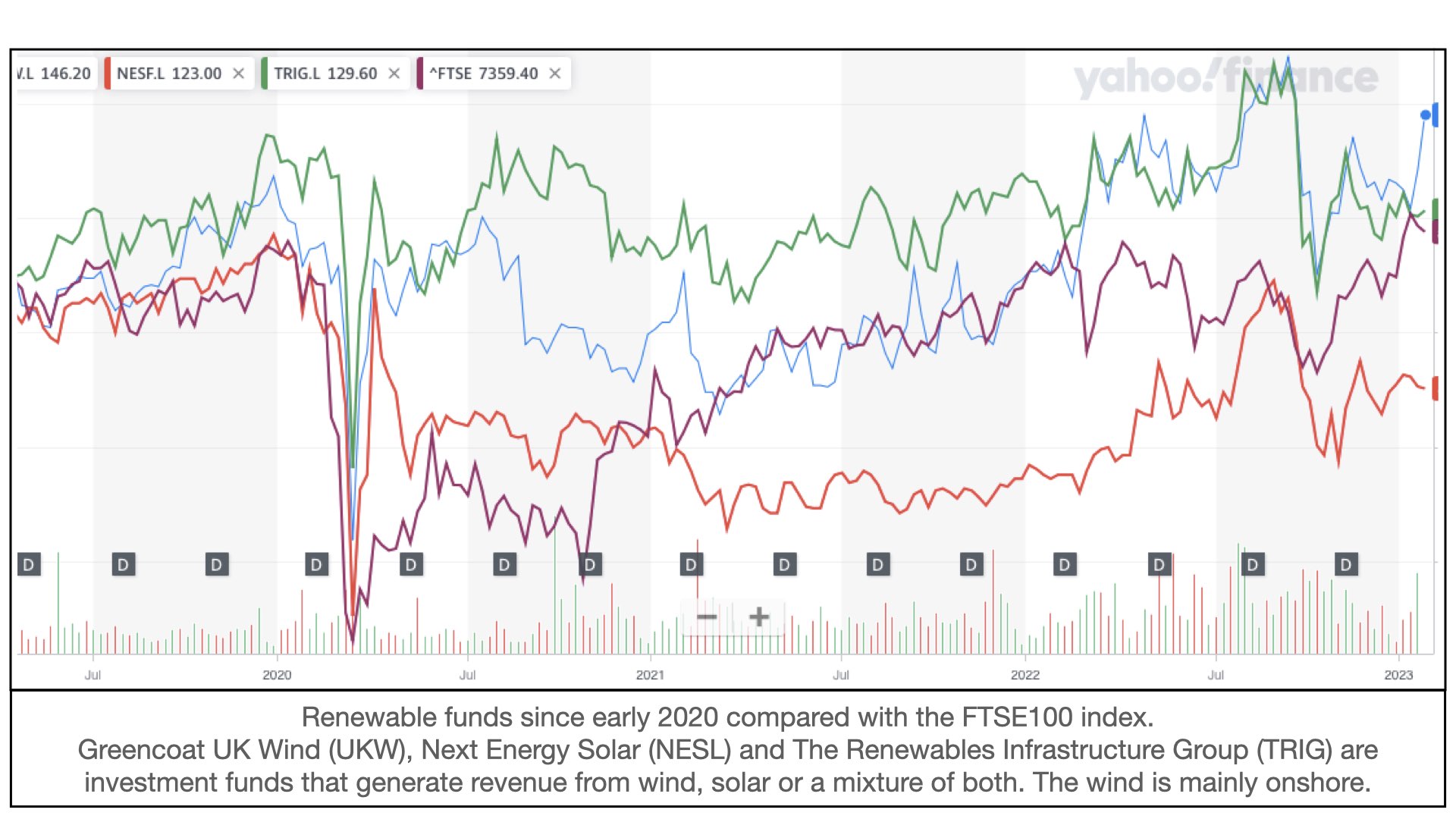

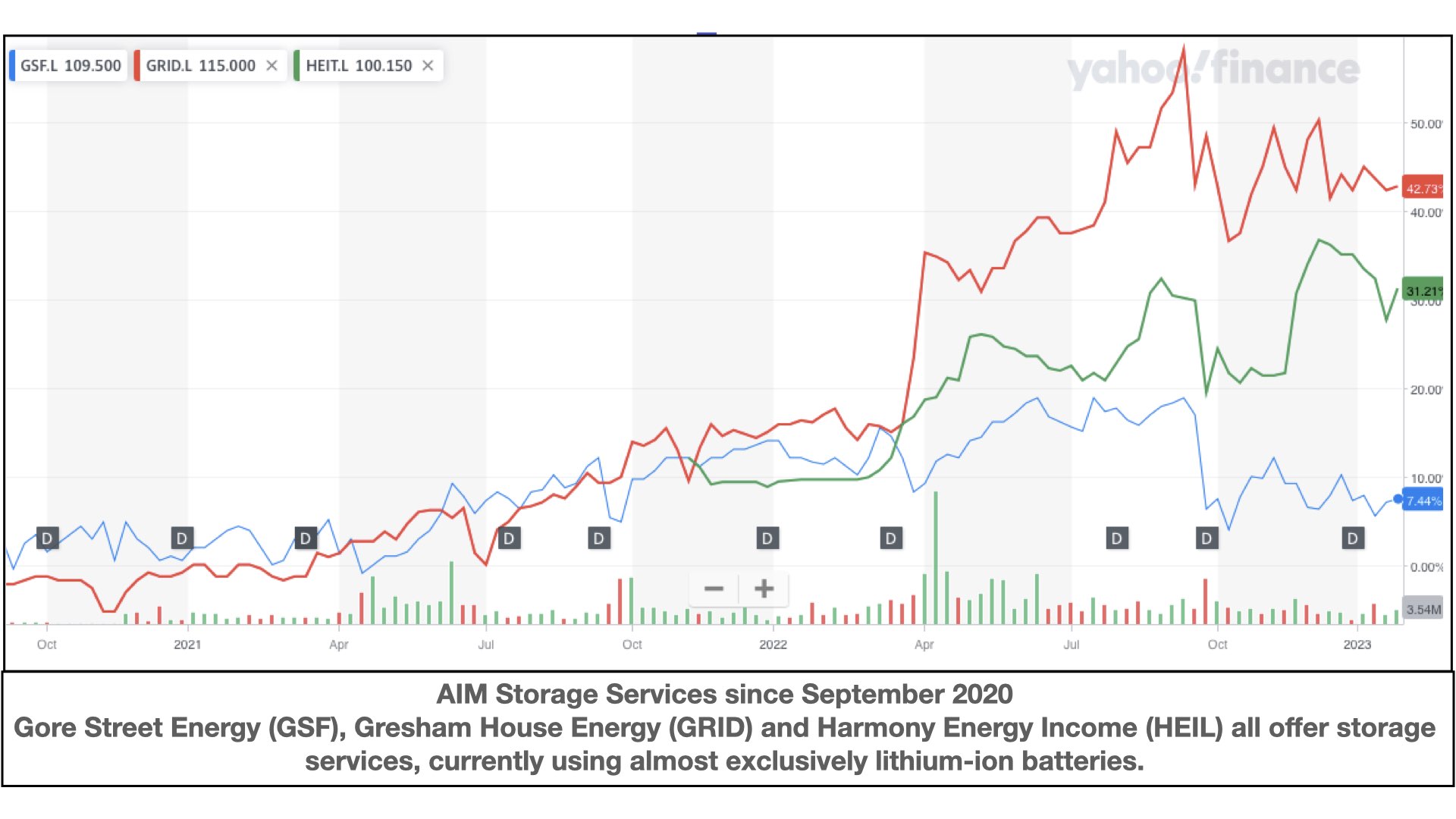

Fortunately, some other categories have done better (see below). Two of them, renewable funds and storage services, are not involved in developing new technology, but act more like utilities by investing in operating wind or solar farms (in the case of the funds), or in battery storage. The funds provide a good, regular return on investment, as they have always done, while the storage services are relatively new. However, neither group is at the forefront of technology, with the share price reflecting the safe, conservative nature of the investment. The funds are almost entirely invested in onshore wind and solar farms, many with guaranteed subsidies from ROCs. The storage companies so far only use Lithium-ion batteries, rather than the wide range of other techniques being developed, and support only very short-term storage: essentially grid balancing rather than day long or seasonal storage.

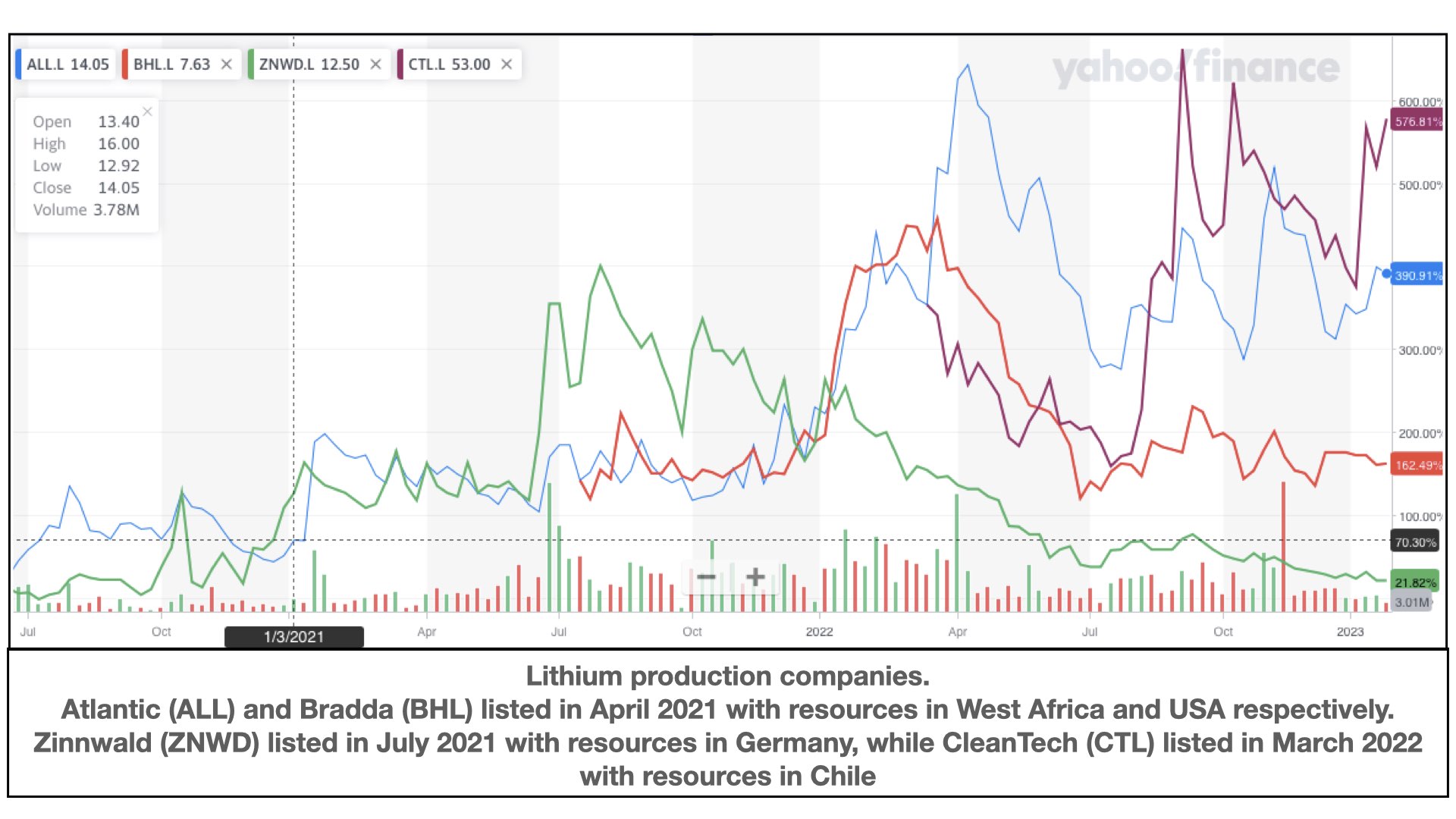

The final category shown below consists of Lithium miners. Their share price trends are varied as are the areas of the world in which they intending to mine. The demand for their product is not in doubt, but the quality of assets and the difficulties of exploitation may vary considerably.

There is a long running discussion among people who model the energy transition over whether it will be solved by doing more of the same – more electricity from more wind, solar and nuclear fission – or whether we will only get there by inventing new techniques of, for example, extracting carbon from the air, producing synthetic fuels or making nuclear fusion work. With limited resources it is not possible to go full out on both ways so choices are necessary. Meanwhile, investors in AIM-listed renewable shares have clearly done better in the recent past from the safer funds and services, but it will only take one of the technology developers to break through for the picture to change dramatically[1].

[1] Some of the stocks mentioned have recently moved from AIM to the main board