By Julian Singer

On 24 May the energy company SSE published its preliminary results for the year to 31 March 2023, showing an adjusted operating profit of £2.5bn, up from £1.5bn a year ago. This strong showing is not surprising given that the largest segment of the company’s energy production is from thermal power plants and gas storage. The profit from the latter increased seven-fold while that from thermal generators (mostly closed cycle gas turbines) increased by a factor of three. Part of this increase is explained by the acquisition, in conjunction with Equinor, of Triton Power’s three generators and by a high efficiency gas turbine plant, Keadby2, coming on line. The remainder comes fromthe unfortunate fact that the higher and more volatile the gas price the more profit can be made from gas in storage and from fast responding thermal generators.

However, as SSE are quick to point out, profits from thermal generators have been slim in earlier years while those from gas storage have been particularly weak. SSE, unlike other energy companies, has at least maintained a storage system, to everyone’s benefit during last year’s energy crisis, even if the volume is small.

Thermal generators and storage accounted for 49 per cent of operating profit in 2022/23 while 30 per cent comes from Transmission and Distribution and 23 per cent from Renewables. The remainder, consisting of various energy supply divisions, ran at a loss. Operating profit is highly influenced by hedging and forward pricing: a better idea of the size of the operation is given by the electricity generated: 18.3 TWh of thermal generation versus 10.2 TWh of renewables. Of the latter 4.4 TWh came from onshore wind, 1.8 from offshore wind, 3.0 from conventional hydro, with the remainder from pumped storage and other sources[1].

www.sse.com

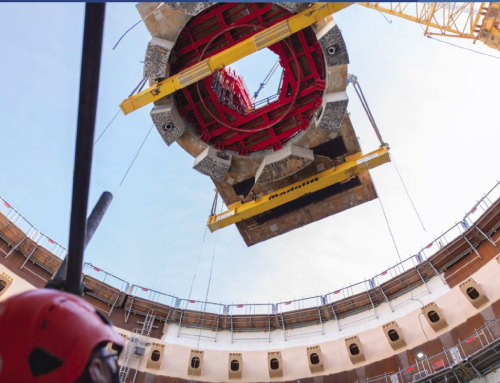

Wind generation was lower than expected due to lower wind speeds than the long-term average (although better than in 2021/22) and delays in the construction of the Seagreen project. The latter is a large 1.075 GW field with 114 turbines offshore Montrose that should achieve full commercial operation by the middle of this year. It is being jointly developed with TotalEnergies and boasts the deepest water in which a fixed turbine has been installed worldwide (at 58.6m).

What does SSE plan to do with these increased profits? Since 2021 the company has had a Net Zero Acceleration Plan that lays out five-year targets for investment in renewable capacity and transmission networks. This plan has now been upgraded to NZAP Plus, increasing capital investment to £18bn by 2026/27 so as to double the Regulated Asset Value of its transmission and distribution networks and to more than double its renewable generation capacity from the current 4GW. The plan also forecasts that net debt will be less than four times annual EBITDA expectations and that the dividend will grow between 5 and 10 per cent in the period.

SSE has about 15GW of renewable generation projects in the pipeline although only some of these will come on-line within the five years. Offshore wind accounts for the largest part, with the Dogger Bank A,B and C projects with Equinor accounting for 4.5GW, but the company also plans additions to its hydro and onshore wind capacity and sees promise in new battery plus solar projects. Some £2.5bn of the investment will be in “low carbon flexible thermal generation”. This includes sustainable biomass, carbon capture and storage for its gas turbine plants and eventually hydrogen.

The results of the last financial year have again shown the advantage of a varied source of income. Of course the thermal plants must be wound down as renewable generation picks up. In the meantime they have generated income that will be used to fund new renewable generators and expanded electricity networks. CEO Alistair Phillips-Davies foresees that the company could invest up to £40bn over the next decade. Others should take note, especially Shell and BP (with earnings of £7.8bn and £6.6bn respectively in the first quarter alone)

[1] To put this in perspective total UK electricity generation in 2022 was 326 TWh.