By Martin Clark

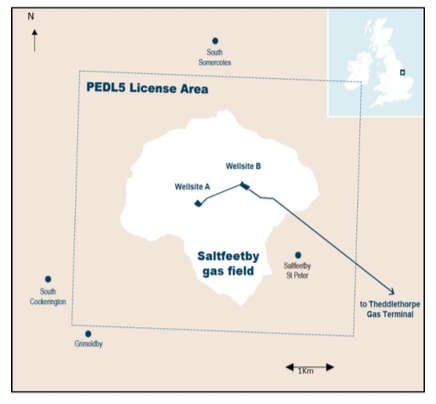

It has been a big week for AIM-listed Angus Energy plc after the company announced that it had made its first nominations for gas export and sale from its Saltfleetby field in the UKThe company holds a 100 percent interest in the onshore gas field (PEDL005), which is located in Lincolnshire, in the eastern part of England.

On 31 August, 2022, it reported that it made its first nominations for gas export and sale to Shell via National Grid, beginning with the Gas Day of Tuesday 30 August 2022, and will continue to make further nominations throughout the week.Additional details on gas volumes achieved will be reported when flow rates have stabilised, it noted in a press statement.

It’s perfect timing for UK gas consumers given the current squeeze on energy supplies, and a big vote of confidence in the Angus Energy team’s ability to get things done.The news pushed its share prices to a yearly high, generating a huge level of interest in the London-based company, which had been issuing regular updates through this summer ahead of the much-anticipated launch.

In May, it announced a deal worth up to £14 million to buy out its minority partner in the Saltfleetby field, which held a 49 percent stake, giving the company total control of the project.As well as the extra cashflow boost, the move provides a stronger platform for the development of the company’s other wide-ranging pool of assets, a point echoed by chairman Patrick Clanwilliam in the 2020-2021 annual report.

Angus Energy describes itself as an independent onshore energy transition company with a mixed portfolio of clean gas development assets, onshore geothermal projects, as well as legacy oil producing fields. Its vision is to become a leading onshore UK diversified clean energy provider and energy infrastructure company.

In effect, this means extracting value from its legacy oil assets, and providing the UK market with much-needed gas as the transition energy of choice, while exploring other potential options and alternatives, such as geothermal. Much of this is reflected in its current asset portfolio.

In addition to Saltfleetby, it majority owns and operates conventional oil production fields at Brockham (PL 235) and Lidsey (PL 241), and has a 25 per cent operating interest in the Balcombe Licence (PEDL244), all in the Weald Basin in southern England. At the Brockham oil field, the company recommenced production and water re-injection in the Portland reservoir in May, in which Angus has an 80 per cent interest.

Current average rates of production from the BRX2-Y well are 50 barrels of oil per day (bopd), it announced on 22 May, 2022, with over 400 barrels stored for sale at that time. Looking ahead, the company is also gaining ground with its geothermal ambitions following studies over an area in south-western England during the past year.On the back of these results, Angus Energy has entered into discussions with several landowners with a view to acquiring site land leases and continuing its exploratory work in more depth.

It set out its intentions to become a low-cost UK producer of baseload geothermal power in 2020 and sees this as an area which can make a significant long-term contribution to the business. It has also held initial meetings with National Grid to establish a connection point for up to 200 megawatts of capacity which will act as a centralised offtake point for its potential project portfolio in the south-west region.

There’s still a long way to go, though the significance of cashflow from projects is not to be understated. In its latest set of published results – the interims for the six months ended 31 March 2022 – the group recorded a loss of £31.750m for the period. But with the Saltfleetby project now flowing gas, coupled with strong support from funding partners, and enthusiastic demand for locally-sourced energy, this is a story to watch. At the close of play last evening Angus’s share price stood at 52-week high of 2.45pence against a low of 0.60p