By Julian Singer

In March the Department for Business, Energy and Industrial Strategy (DBEIS) issued its Industrial Decarbonisation Strategy as promised in the Energy White Paper of last November.

The UK industrial sector contributes 9 per cent of the UK’s GDP and provides 2.6 million jobs directly, but emits 16 per cent of UK emissions, or 72 million tons of CO2 equivalent (MtCO2e). These emissions have been declining steadily for a number of years through improvements in efficiency, better use of resources and recycling. There are various incentives and levies to encourage these improvements, but the limit to what can be achieved will be reached in the next ten years. The Strategy looks at what extra steps are needed in order to reach net zero by 2050.

Decarbonisation of industry presents many challenges: there are manufacturing processes for products such as cement, steel and petrochemicals that depend directly on the use of coal or oil, so cannot be decarbonised by simply converting the source of power to renewables. If the producer is forced to bear the cost of decarbonising his product is likely to be uncompetitive, thereby affecting UK GDP and employment and leading to CO2 “leakage” – meaning that production and investment will go to carbon emitting producers abroad.

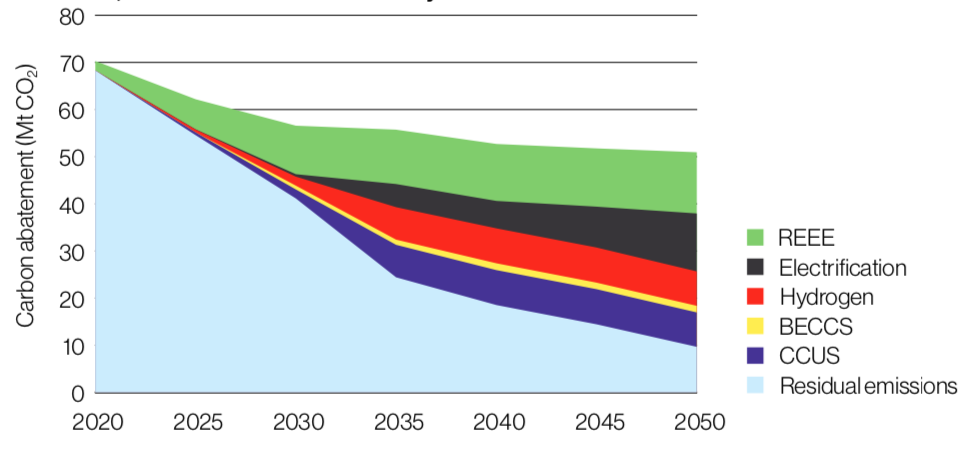

One of the key strategies, already well advertised by the government, is the focus on industrial clusters, the six largest being Humberside, South Wales, Grangemouth, Merseyside and Southampton (in decreasing order of emissions). The other strategies are conveniently summarised in the chart below, which shows the decrease in carbon emissions from now until 2050 with the methods proposed.

Decarbonisation for industry in clusters only

The top line (along the top of the green) shows the carbon abatement with current policies. These are not negligible. The report lists no less than eighteen schemes into which the government expects to put around £3 billion a year and industry £1bn a year for at least the next five years. One of these, the Emissions Trading Scheme, is estimated will cost industry (and therefore, no doubt, customers) £390 million a year and the government £1bn in free allowances. Others include the Renewable Heat Incentive and several innovation or improvement programmes.

The green area in the chart represents abatement by Resource Efficiency and Energy Efficiency (REEE) which includes the increased reuse, recycling and substitution of materials such as steel, improved energy management and heat recovery, development of digital technologies and so on. How these initiatives and their expected abatement differ from those already in place is not at all clear. Nevertheless the total planned reduction in emissions until 2030 comes almost entirely from these two factors.

Almost all manufacturing processes require heat, presently supplied by burning oil, gas or coal. Industry therefore needs to implement Fuel Switching. If the temperature and amount of heat required is small the switch can be to renewable electricity, leading to the abatement shown in black above. Otherwise the plan assumes the switch will be made to hydrogen, shown in red above. For example, steel can be made using hydrogen instead of coke (“green steel”) but the process is not yet proved at scale. For this reason and because of the limited amount of hydrogen expected to be available, there is little impact before 2030.

Bioenergy with carbon capture (BECCS, in yellow) plays a small role, while carbon capture, use and storage (CCUS) will allow industry to continue to use oil or gas. The infrastructure for the first two CCUS clusters is expected to be in place by 2025, with two more added by 2030.

In spite of all this there are still residual emissions of over 10 MtCO2e in 2050. This is because nearly half of UK industry, in terms of emissions, does not take place in clusters. Cement is a particular problem, since very little is manufactured at the cluster sites. Cement currently produces 4.2 MtCO2e, but there are also other energy intensive industries producing 12.3 MtCO2e and less energy intense industries producing 17.1 MtCO2e.

The problem is how to transport electricity and hydrogen into and CO2 out of these sites. In a cluster it is assumed that abundant electricity is available, that hydrogen is manufactured on site and that there is a pipeline to dispose of CO2. Away from the clusters it is not yet clear what exactly will be needed. Pipelines and transmission lines are expensive, have long lead times and require co-ordination between many parties.

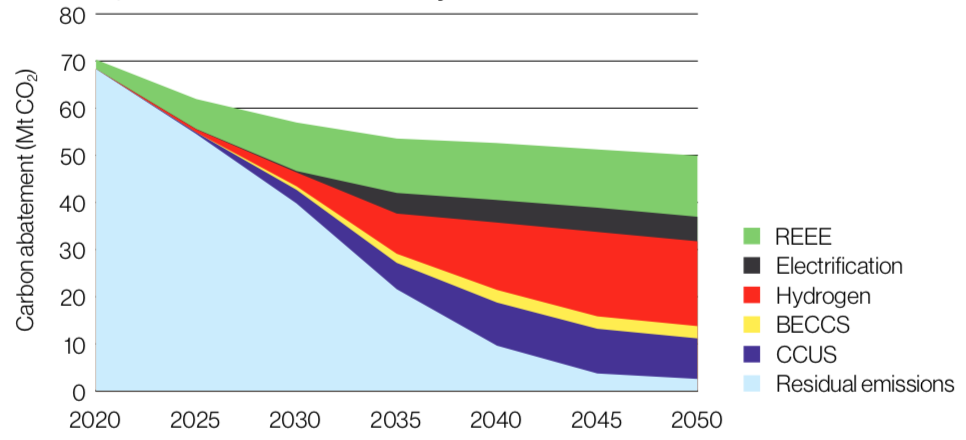

However, with certain assumptions, the report shows that nearly all industrial carbon emissions can be abated by 2050, as in the plot below. In this scenario hydrogen plays the predominant role while electrification is somewhat less.

Decarbonisation for industry nation wide

These plans involve plenty of extra costs, some of which the document identifies. Many still need to be worked out during this decade. To be successful both investors and consumers must be convinced since taxpayers, via the government, cannot bear the full cost. To encourage private investment the government will focus on an effective carbon-pricing mechanism, funding to overcome barriers to investment, and policy reforms to prevent carbon leakage overseas.

For their part, consumers will need to pay more for a wide range of products, although how much after the initial investment is not yet clear, unsurprisingly. The Strategy proposes to develop labelling to identify low carbon products in the same way that food is labelled. This may not change customer’s choices much but should put pressure on producers t meet their promises.

The 168 page document certainly puts flesh on the bones of the Energy White Paper of November 2020 and the Prime Minister’s Ten-point plan. Plans, though, are one thing, reality is different. The test is still to come.