Decarbonising a developed economy is a difficult task, but it is especially challenging when that economy is a major producer of fossil fuels. For a long time the U.S.A. has been a major producer as well as the leading centre of expertise for the oil and gas industry, but in the last few years its importance has grown substantially. In 2020 it will become a net energy exporter for the first time since 1953. It is already a net exporter of natural gas while in mid 2018 it became the world’s largest producer of crude oil. Asking the USA to give up producing oil and gas is like asking Scotland to give up producing whisky.

Therefore it is not surprising that the US Energy Information Administration (EIA) predicts that US CO2 emissions will remain essentially flat out to 2050 with only small reductions from the industry and electric power sectors (although the latter has dropped substantially over the last ten years).

Dr Marilyn Brown, Professor of Sustainable Systems at Georgia Institute of Technology, addressed this problem in a talk to the Oxford Energy group on 18 June entitled “Empowering the great energy transition while fossil fuels are still abundant: the U.S. challenge”. Her solution is a carbon tax, for which she claims there is bi-partisan support. Democrat candidates have proposed the Green New Deal, which requires a transition to 100 per cent renewables by 2030 at a cost of up to $1 trillion annually to be funded by the equivalent of a carbon tax at $60 per metric ton of CO2 (tCO2). On the Republican side James Baker and George Schulz, both once Secretaries of State, proposed a carbon dividends plan in 2017 with revenues recycled to households.

Dr. Brown has modelled the effect of a carbon tax on the electric power sector, which accounts for about 35 per cent of US carbon emissions. She considers the effect of introducing different levels of tax on the means of generation, electricity prices and other factors. She also considers the effect of energy efficiency measures such as improved appliances and building codes. It seems that improvements to existing homes were not included.

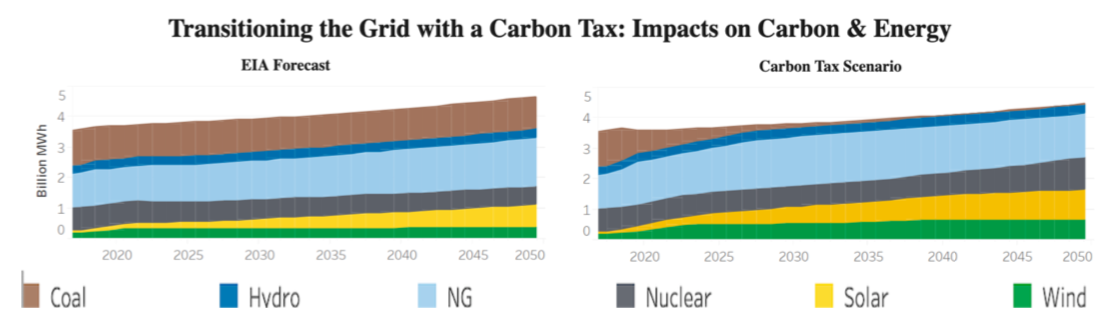

Her median case considers a tax of $25 per tCO2 in 2020 which grows 5 per cent annually to reach $108 in 2050. The result is shown below. Whereas the EIA forecast would lead to 54 Gigatons of CO2 from the electric sector between 2016 and 2040, this case would lead to 37 GtCO2.

Predicted change in total electricity generation and source of generation with and without a carbon tax of $25 per tCO2 in 2020. With the tax, coal is eliminated by 2030, natural gas grows rapidly until then, after which it remains flat at a third of the total. Wind flattens out while solar grows slowly and nuclear grows a little after 2040.

This is a very different picture to that in the UK, with the government’s ambition of reaching zero emissions in 2050. It is surprising that wind and solar do not grow more rapidly. Dr. Brown sees various difficulties. One is that power utilities in many states are small or vertically integrated and so less able or willing to adopt a new source of power. Another is insufficient transmission. She was involved in the plan to bring high voltage DC power from Oklahoma wind farms to Tennessee and the east coast. It was recently put on ice because of cost and the political difficulty of getting agreement from the states through which it passed.

To UK eyes the taxes considered are moderate. The average US household uses about 10,000 kWh per year at a cost of $1200. If this was produced solely from natural gas the tax would be $50 using her median scenario and given that natural gas releases 200 grams of CO2 per kWh when burnt. In practice there are other emissions related to producing and transporting the gas.

Dr.Brown has also looked into how the funds from the carbon tax are used. She assumes that they will be distributed to households to moderate the increased electricity price, predicted to be 15 per cent in 2030 rising to 24 per cent in 2050 with the scenario above. The key question is how.

If they are distributed equally per capita, the dividend (for this scenario) would be $106 per household in 2020 increasing to $115 in 2050. Since most fossil fuels are found in the central and mid-western states whereas the highest population centres are on the Pacific and in the North-East, there would be a large transfer of wealth from the former to the latter.

If on the other hand the dividend is distributed based on regional CO2 emissions the reverse is true, with the Pacific region dividend varying from $25-35 and the four central regions ranging from $150-200. This method would seem to give the central regions a perverse incentive to maintain their emissions. Whichever path is chosen the issue of distribution is likely to make the introduction of a carbon tax more difficult and to keep politicians busy for several years.

Overall these results are quite pessimistic for renewable energy. They are limited in that trends such as the advent of electric vehicles and techniques such as carbon capture and storage are ignored. However they highlight the difficulties that the federal government faces in decarbonising the economy even if, unlike at present, it actually wanted to.